|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

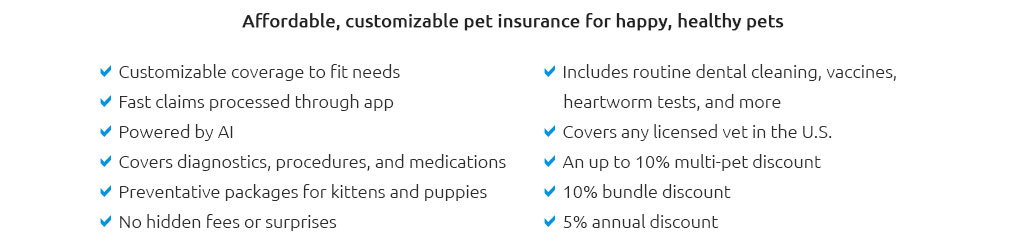

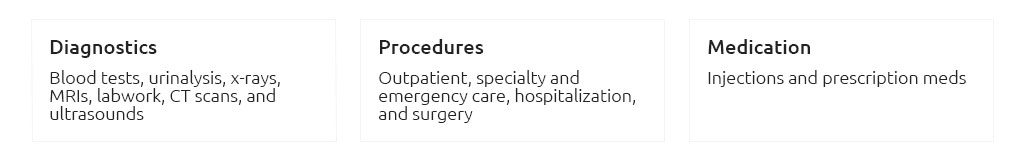

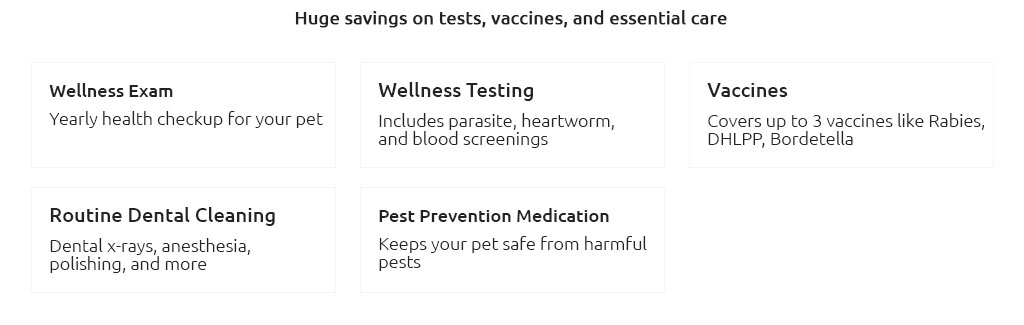

Pet Health Insurance for Cats: Navigating the Feline Healthcare MazeCats, those enigmatic and graceful companions, have long captivated the hearts of many, becoming an integral part of our lives. As their caretakers, ensuring their well-being is paramount, yet the topic of pet health insurance for cats often leads to a myriad of questions and decisions. With veterinary costs on the rise, pet health insurance has emerged as a pragmatic solution for many cat owners, providing peace of mind and financial security. While some may argue that putting aside savings could suffice, unforeseen circumstances can rapidly exhaust even the most meticulously planned budgets. Thus, having a robust insurance plan tailored to your feline's needs is not just a precautionary measure but a thoughtful investment in their health and happiness. When selecting a pet health insurance plan, several factors demand careful consideration. Understanding Coverage Options is crucial. Insurance plans for cats typically cover a range of medical issues, from accidents and illnesses to more comprehensive plans that may include preventive care. However, not all plans are created equal. It is imperative to scrutinize what each plan covers and excludes, paying special attention to hereditary conditions and chronic illnesses, which can be more common in certain breeds. Budgeting and Premiums are also significant components to evaluate. Premiums can vary widely based on factors such as the cat's age, breed, and location. While it might be tempting to opt for the cheapest plan available, consider the potential out-of-pocket costs in the event of a medical emergency. A slightly higher monthly premium could, in the long run, save a substantial amount of money. Choosing the Right Provider requires due diligence. Look for insurers with a solid reputation, excellent customer service, and a straightforward claims process. Reading reviews and seeking recommendations from fellow cat owners or veterinarians can offer valuable insights into which companies consistently deliver on their promises.

Ultimately, investing in pet health insurance is a decision that reflects a commitment to your cat’s long-term health and well-being. While it requires a thoughtful analysis of various options, the peace of mind it provides is invaluable, allowing you to focus on cherishing the joyful moments with your feline friend. Frequently Asked QuestionsIs pet health insurance for cats worth it?Yes, for many cat owners, pet health insurance is a worthwhile investment. It can significantly reduce the financial burden of unexpected medical expenses and ensure that your cat receives the best possible care. What does cat insurance typically cover?Most cat insurance policies cover accidents, illnesses, surgeries, and some emergency care. Some plans may also include wellness care, such as vaccinations and routine check-ups, but it's important to check the specifics of each policy. Can I get insurance for an older cat?Yes, many insurance providers offer plans for older cats, although premiums may be higher and certain pre-existing conditions may not be covered. It's advisable to enroll your cat as early as possible to maximize coverage options. How do I choose the best insurance for my cat?To choose the best insurance, compare different plans based on coverage, cost, customer reviews, and the insurer's reputation. Consider your cat's health history and potential future needs when making your decision. https://www.pumpkin.care/cat-health-insurance/

If your kitty gets hurt or sick, a Pumpkin Cat Insurance plan can pay you back for up to 90% of eligible vet bills. This can make it easier to get the best care ... https://www.embracepetinsurance.com/cat-insurance

For thousands of cat parents, Embrace offers affordable, comprehensive coverage and wellness rewards that fit your budget and provide the coverage you need. ".. https://www.petinsurance.com/

A pet insurance plan lets you give your furriest family members the best health care possible by reimbursing you for eligible veterinary costs.

|